When.buying a House Can You Sell It Again

You lot could plow around and sell your abode the day after yous purchase it — nobody is making you stay. But selling your home soon later buying tin can mean losing money, missing opportunities, facing capital gains taxes or paying mortgage prepayment penalties.

The typical seller lives in their home for 15 years before putting it up for sale, co-ordinate to the Zillow Group Consumer Housing Trends Report. A dwelling house is well-nigh people's largest fiscal investment, so homeowners tend to stay long enough to gain pregnant disinterestedness. But life can change unexpectedly, and you may need to motility sooner than you had planned.

Reasons homeowners sell sooner than expected

Unless you lot're a professional home flipper, you probably weren't planning on selling soon afterward buy. But in that location are plenty of reasons people end upwards selling within a year or two of purchasing:

Chore relocation : Y'all may demand to move for a career opportunity or to shorten your commute.

Health emergency : Yous may need to gratuitous up disinterestedness to pay medical bills or living expenses.

Buyer's remorse : You might notice that the house y'all bought isn't the right fit.

Family changes: A new family member, kids leaving for higher or a death in the family can crusade people to sell and notice a better habitation for their needs.

Fiscal toll : Your mortgage payment might be too expensive, or your belongings taxes increased too much.

Hot sellers market : Yous may have gained equity quickly, and yous want to accept advantage of the opportunity to profit while you can.

How soon tin you sell a house after buying without losing coin?

Technically, you're free to sell anytime after closing 24-hour interval. But is it a smart financial move?

On average, selling in less than a year eliminates the financial benefit of homeownership. Information technology's not just about selling the house for what you paid for it. You'll as well need to gene in the costs associated with buying, the costs associated with selling, the equity gained or lost, and moving expenses.

If the costs of selling are new for yous, bank check out the Home Sale Calculator to explore the typical itemized costs.

The breakeven horizon

The breakeven horizon is the corporeality of fourth dimension it would take for ownership to make more financial sense than renting, factoring in all the expenses that come with purchasing a home.

Y'all might think that staying put for a short fourth dimension means renting makes the most sense. But two years and 3 months is the boilerplate amount of time yous'd need to own the nation'south median-valued home to accrue enough equity and/or pay down the balance on your mortgage enough to make information technology financially more than toll-effective than renting a typical apartment.

The breakeven horizon assumes a xx% down payment and monthly payments on a 30-yr fixed-charge per unit mortgage at the current interest rate for people with credit ratings between 680 and 740. The tool takes into consideration current and expected market appreciation rates to assistance determine earned equity. It also calculates taxes, insurance, closing costs, maintenance and fifty-fifty HOA fees for condos, plus viii% selling costs to realize the profit on selling.

You can utilise this breakeven horizon as a skillful indicator of how soon y'all can sell a home afterward buying it without losing money in the investment, noting that the horizon varies based on where you live.

For example, as of April 2019, the breakeven horizon for the typical home in the city of Seattle is four years, iv months — much longer than the national average. In Philadelphia, buying becomes the financially smarter choice much more than speedily — after just one year and x months.

When does it benefit yous to sell fast?

Sometimes information technology's possible to turn a profit even if you sell before than your area's breakeven horizon. Here are a few common instances:

- You flipped the house, making significant renovations in a short period of time to increase the domicile's resale value.

- Home values in your neighborhood shot upward unexpectedly, due to new evolution in your expanse or a large company moving in nearby.

- Yous got a good deal initially. If yous originally bought your habitation as a foreclosure or a short auction and can sell information technology under normal circumstances, yous might plow a profit.

Summate how shortly you lot can sell a house after buying it

While yous can sell someday, it'southward usually smart to await at least ii years before selling. This gives you lot fourth dimension to (hopefully) gain some disinterestedness to outset your endmost expenses. And by living in your dwelling house for at least 2 years, you can exclude upwardly to $250,000 (or $500,000 if you're married) of the profits made on your auction from your taxes — more on that later.

Of course, there are times where you simply can't wait two years to sell. If you're in this position, do the math kickoff so you can anticipate any potential loss you'll take. Knowing your financial outcome ahead of time tin lower stress and assist you make practical decisions.

Become the fair market value

Beginning, figure out how much you'll be able to sell for and then you'll know how much you stand to gain or lose. If y'all're selling on your own, consider hiring an appraiser to provide the marketplace value of your habitation. If y'all're working with a real estate agent, they should help you identify the off-white market value of your habitation and advise a listing price, using neighborhood comps and market analysis.

Subtract closing costs from projected sale cost

Endmost costs can swallow a lot of your profits, peculiarly when y'all're buying and reselling in a short menses of time. Make sure you lot factor endmost costs into the equation.

Buyer closing costs

Heir-apparent closing costs usually total 2% to 5% of the purchase price of your home. You tin find the total amount you paid to buy your dwelling house by looking at your settlement statement. Note that information technology's common for buyers to enquire for sellers to embrace closing costs as part of the negotiations, and so it's possible y'all didn't pay much when you purchased your home.

Seller closing costs

Closing costs for sellers can total eight% to 10% of the sale price. The bulk of this cost goes to commissions. The seller typically pays both their agent's commission and at least a portion of the buyer's amanuensis's commission, which together total 5% to 6% of the auction price. On a $200,000 home, that ways your closing costs can range from $xvi,000 to $20,000.

The most common charges include:

- Agent commissions

- Title insurance

- Escrow fees

- Transfer and/or excise tax

- Prorated property taxes

- Prorated HOA fees

- Attorney's fees

Subtract seller prep costs from projected sale price

Even if yous've lived in the house for a curt time, you may all the same need to do some prep work earlier list. According to Zillow inquiry, sellers who hire professionals to help them get ready to sell their home spend an boilerplate of $half dozen,570. This includes tasks similar painting, staging, business firm and carpet cleaning, lawn intendance and gardening, and local moving costs.

Decrease mortgage payoff amount from projected sale price

If yous've owned your home for less than a twelvemonth or 2, your payoff amount won't be significantly lower than the corporeality you originally financed. At the beginning of a loan, almost of each monthly payment goes to interest, non principal, then you won't take made enough payments to make much of a paring in your loan principal.

Unless you've been making significant additional chief payments every month, it'due south unlikely that your mortgage payments solitary volition cover the selling costs and permit you to interruption even. If you're looking to make a profit, you'll have to count on the amount your property has increased in value during your time owning it.

Other consequences of selling a dwelling house early

In addition to hefty prep and closing costs, consider some boosted consequences of selling shortly later on buying.

Uppercase gains taxes

If you've lived in your dwelling for at least ii years and information technology'southward your master residence, yous are exempt from paying capital gains taxes on the profits of your sale — up to $250,000 for an individual or $500,000 as a couple.

But if you lot're selling your main residence earlier you have lived at that place for two years — or at least 2 of the last 5 years — you may exist field of study to capital gains taxes (of form, capital gains taxes simply apply if you turn a profit).

Majuscule gains revenue enhancement rates vary based on how long you've owned the habitation and your income tax bracket. It's worth noting that if you've lived in your house for less than two years, at that place are some cases where yous may exist exempt from paying capital gains taxes — like if you lot motion because of a natural disaster, decease or unemployment. Anytime you have capital gains tax-related questions, exist sure to consult your tax professional.

Mortgage prepayment penalty

Some lenders charge a prepayment penalty if you lot sell your abode within a certain time menstruation after buying. It's a way for lenders to recoup some of the interest payments they won't be getting since yous're paying your loan off so before long. The amount you'll take to pay depends on the terms of your loan. It could be a percent of your remaining loan balance (usually between 2% to v%), a percent of owed involvement or a apartment rate.

Most loans today don't accept prepayment penalties, and in that location are never prepayment penalties on FHA loans.

Negative heir-apparent perception

Since listing history is readily bachelor on sites like Zillow and Trulia and on local MLS systems, buyers and their agents tin see when you purchased and what you paid. If y'all're selling less than a yr after ownership, buyers might wonder if there's something incorrect with the home or its location.

This negative perception could lead to lower or fewer offers, unless you brand it clear in the listing why you're selling (e.g., "seller must relocate").

Can you sell a house inside 6 months of buying it?

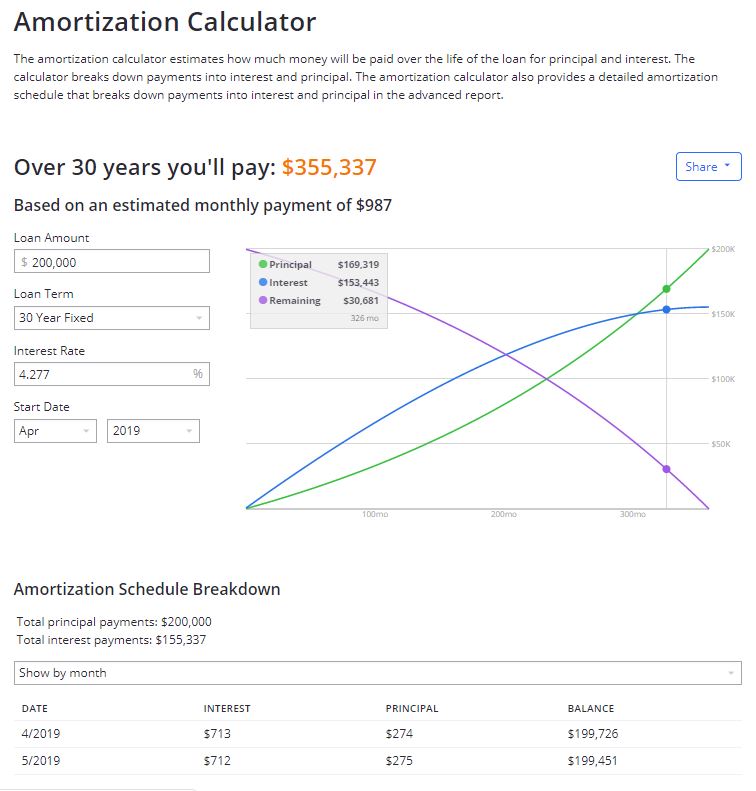

As mentioned higher up, you tin can sell your home whenever you want, only yous're probable to lose money if y'all sell within the beginning six months of owning. Here'south an example, using figures from Zillow's mortgage calculator tool and amortization calculator.

How to calculate your internet proceeds afterwards half-dozen months of homeownership

- Habitation was purchased for $200,000 in Oct 2018.

- Abode was endemic for half dozen months.

- Habitation was purchased with 20% down ($forty,000).

- Closing costs for buying were three% of purchase toll ($6,000).

- Financed $160,000 at a 4.five% interest rate, 30-year stock-still loan, for a monthly payment of $811.

- Equity of $ane,276 gained in first six months from paying mortgage principal.

- Endmost costs upon selling domicile were around $20,000.

- Total loss is $26,000 (buying and selling closing costs combined), combined with $1,276 in equity gained, for a net loss of $24,724.

That ways you'd have to sell your domicile for at least $224,724 to suspension even, and y'all still wouldn't recoup the amount spent in involvement payments ($three,588 in three months), property taxes ($1,482 in vi months) and insurance ($420 in six months). Note that we didn't include these in the calculation to a higher place, because some of these expenses would have been incurred if yous had endemic or rented elsewhere, instead of ownership when you lot did.

Source: https://www.zillow.com/sellers-guide/how-soon-can-i-sell-my-house-after-purchase/

0 Response to "When.buying a House Can You Sell It Again"

Post a Comment